Uncertain Times

When Our Edge Comes Handy

Since 2009, the nature of markets has been tempered by exceptional accommodation from central bankers around the globe. Now that we are leaving these calm waters as recent events such as the Covid pandemic, the war in Ukraine, or the increase in inflationary pressures brought fear into the global markets, we are left with the reality of subpar growth, high indebtedness, income disparity, lack of structural reforms, and a high degree of uncertainty due to globalisation backlash and the rise of populism. Such uncertainty makes markets prone to sudden outbursts of volatility we have been witnessing in recent years. While uncertainty presents increased risk, the reward seems limited in traditional long-only vehicles with both bonds and equities seeming vulnerable. In such a climate, in which a tweet can move global markets instantly, sudden outbursts of volatility are not unlikely and call for flexibility and quick adaptability to shifting market conditions. Highly experienced, disciplined, and agile boutique investment manager like us offers a speedboat where Titanics are destined to fumble. Our solution to navigate these tricky times is one of quickly adapting to new developments, benefiting from moody markets instead of fearing them, and profiting from up and down movements alike, yet at lower costs and with unrestricted liquidity. All that while constantly conducting research on the market micro- and macrostructure to continually improve our understanding of the market's inner mechanics.

Research

Searching for Harmony When Curiosity Beats Greed

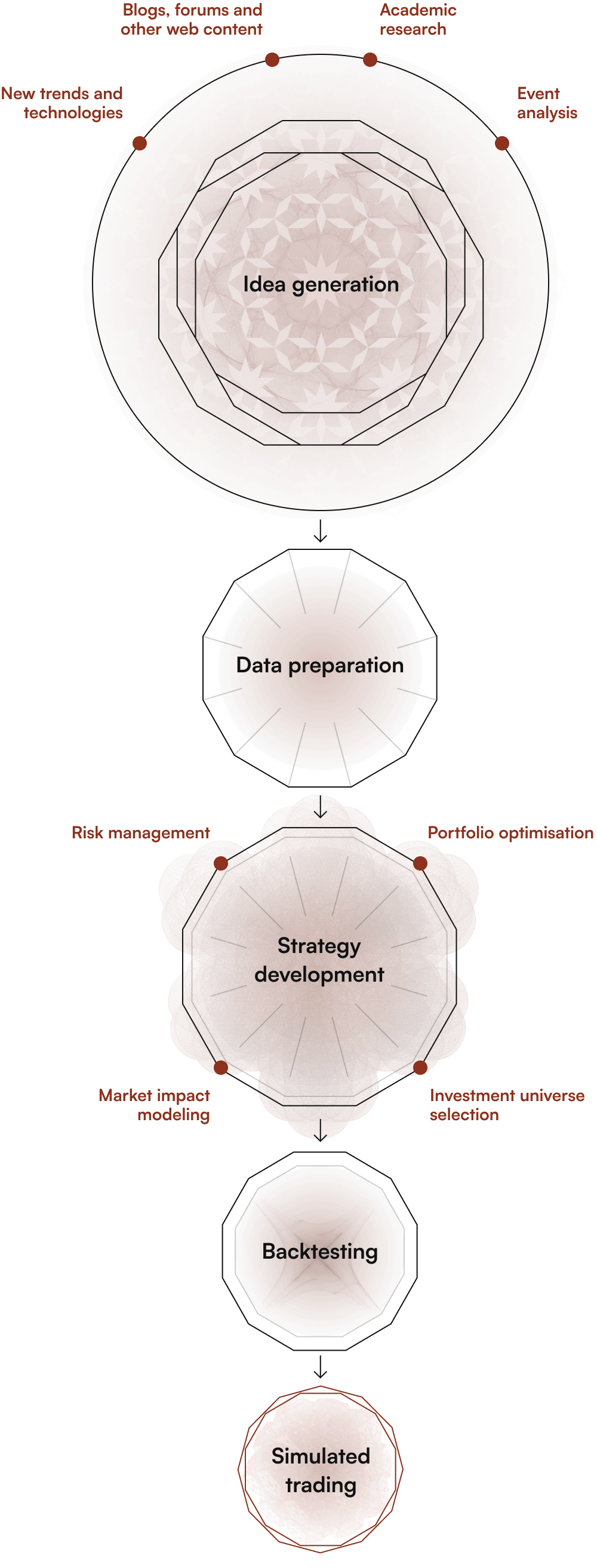

The financial markets have been the object of fascination and an important source of progress in mathematics and statistics, for ages. It's easy to understand why - greed (together with fear) has always been a very powerful incentive to innovate, albeit not the most enlightened one. We, however, made the market the object of our passion and study for a different calling – its subtle, rarely appreciated beauty. Driven by curiosity rather than greed, we admire it as one of the most sophisticated and complex examples of so-called emergence, one of the most robust systems created by mankind exhibiting its own properties, with its own set of flaws and qualities worth exploring. Just as you are much more than a sum of the particles making up your body, so the markets are much more than just a sum of the actions of its participants. As much as the H20 molecules in the body of water are not cognisant of their state of being, they are able to create an emergence of their own – a harmonious pattern we call a wave that we are able to understand, enjoy and utilise – for anything from surfing to energy generation. Similarly, you could say we search for harmonious patterns in the market, the waves to ride if you will. The treasure of order and harmony in the markets is, however, buried deep underneath layers of apparent chaos, due to its inherent complexity being orders of magnitude higher than water. That's why it has so far eluded deeper understanding and why we employ the world-class research team and state-of-the-art statistical and machine learning methods, leveraging computational power unavailable to mere human brain, to constantly improve our understanding of the markets. The result is the discovery of meaningful truths about the world and ourselves, about the ways we humans give rise to levels of emergence beyond our own existence, such as societies or markets. And yes, unsurprisingly, given the natural consistency and inertia of the harmonious patterns that reveal themselves, they can be used for generating profit as well.

Investment Management Services

Fund Formation - Laying the Foundation of Your Future Success

Since 2017, we have been building expertise in complex investment fund structuring across well-established jurisdictions in Europe which is now available to ambitious new projects seeking fund vehicles to operate their investment strategies, increase AUM, and expand activities. We currently offer fund structuring services in six major domiciles – Luxembourg, Ireland, Netherlands, Malta, Switzerland, and Lichtenstein. We approach each project individually and building on our extensive research, we always match a specific investment goal with an optimal domicile based on criteria such as tax and cost efficiency, regulatory flexibility, jurisdiction recognition, or time to market. We specialise in alternative investment funds operating more sophisticated and sometimes fairly “exotic” strategies, including launching one of the first digital asset funds in the region. It is our aim to offer our investors a broad range of truly alternative, high-quality projects with enticing returns and largely uncorrelated with traditional strategies, delivering suitable diversification options to enrich their portfolios. If you believe your investment strategy could benefit from an advanced fund structure, please contact us, and let us discover how we can work together.